XRP Price Prediction: Navigating Bearish Signals Amid Institutional Adoption Wave

#XRP

- Technical Divergence: Price below 20MA contrasts with building MACD momentum

- Regulatory Overhang: SEC case extension could delay institutional adoption

- Institutional Growth: Korean BDACS integration offsets some bearish technicals

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Pullback

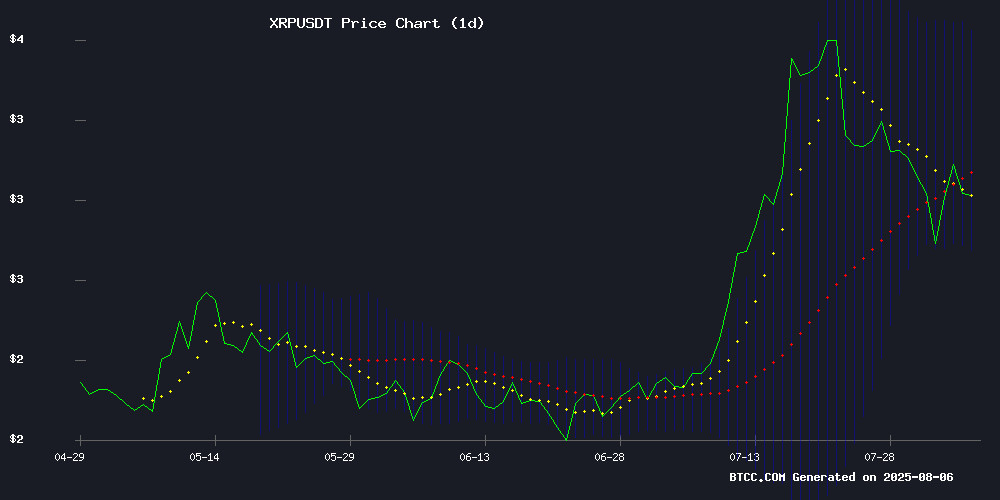

According to BTCC financial analyst Sophia, XRP is currently trading at 2.9962 USDT, below its 20-day moving average of 3.1674, indicating short-term bearish pressure. The MACD shows a positive histogram (0.2137), but the signal line remains negative (-0.0011), suggesting mixed momentum. Bollinger Bands reveal price testing the lower band at 2.7510, which may act as support. Sophia notes, 'While the MACD shows some bullish divergence, the price remaining below the 20MA and testing lower Bollinger Band suggests caution in the NEAR term.'

XRP Market Sentiment: Bearish Headlines Clash With Institutional Growth

BTCC analyst Sophia observes conflicting signals in XRP news flow: 'While bearish technical narratives dominate headlines (MVRV death cross, whale selling), fundamental developments like the BDACS integration in Korea highlight growing institutional adoption.' The SEC lawsuit extension risk and bank charter opposition create regulatory uncertainty, but Sophia emphasizes 'Ripple's remittance partnerships could be a long-term price catalyst despite short-term volatility.'

Factors Influencing XRP's Price

XRP Price Prediction: Pullback Tests Key Support Levels Amid $3.50 Target Debate

XRP's rally faltered after briefly surpassing $3.10, with the digital asset now trading near $2.93—a 3.5% daily decline. Technical indicators suggest weakening momentum as the cryptocurrency breaches a critical bullish trendline and slips below the 100-hour moving average.

The Fibonacci retracement level at $2.92 emerges as immediate support, though bearish RSI and MACD readings hint at potential downward pressure. Market participants await either a decisive break above $3 resistance or confirmation of deeper correction toward $2.75.

XRP Technical Analysis Signals Bearish Trend with MVRV Death Cross

XRP faces potential headwinds as its Market Value to Realized Value (MVRV) Ratio dips below the 200-day moving average—a technical pattern known as a 'death cross.' Historically, this signal precedes significant price corrections, prompting traders to reassess their positions.

The MVRV Ratio, a key on-chain metric, compares XRP's market capitalization with its realized capitalization—the aggregate value of tokens based on their last on-chain movement. A reading below 1 indicates widespread unrealized losses among holders, often foreshadowing bearish momentum.

Crypto analyst Ali Martinez highlights the pattern's reliability in predicting downturns. While some view this as a buying opportunity, the broader market appears cautious. XRP's recent performance underscores the metric's significance in gauging investor sentiment and identifying overextended markets.

XRP Price Prediction: Ripple and Remittix Poised to Transform Global Payments

Blockchain technology is disrupting the $19 trillion cross-border payments market, with Ripple and Remittix leading the charge. Ripple continues to innovate with faster, more secure transactions, while Remittix emerges as a DeFi contender focused on mass crypto adoption. Both platforms exemplify blockchain's potential to solve real-world financial challenges.

XRP's market activity reflects growing interest in utility-driven cryptocurrencies. The token currently trades at $3.05, up 2.26% in 24 hours, with a $181.37 billion market cap and $5.74 billion daily volume. This momentum signals broader demand for solutions addressing cross-border payment inefficiencies.

Remittix represents the next wave of blockchain adoption, building infrastructure for global finance. Its approach complements Ripple's institutional focus, together creating a more accessible financial ecosystem. The sector's evolution suggests speculative phases may give way to substantive technological adoption.

Ripple vs SEC: Extension or Ending? Expert Reveals What’s Next for XRP Lawsuit

The legal showdown between Ripple and the U.S. Securities and Exchange Commission (SEC) enters a critical phase as appeals linger. Attorney Bill Morgan notes both parties are at the final stage—awaiting SEC commissioners' vote to drop their appeal and mutual dismissals. A conditional settlement agreement remains unmet, leaving appeals technically active despite public perception of resolution.

Speculation mounts around an August 15 deadline for potential dismissal. The outcome could set a precedent for crypto regulation, with XRP's market trajectory hanging in the balance. Regulatory clarity—or further delay—will ripple across the sector.

XRP Maintains Price Parity Despite Liquidity Fragmentation Across Exchanges

XRP demonstrated remarkable price consistency between Binance and Coinbase in July, even as liquidity pools diverged sharply between USD and USDT trading pairs. The digital asset maintained near-perfect alignment across venues, with closing prices correlating at 0.999 between USDT pairs.

Binance dominated USDT-quoted XRP trading volume, while Coinbase emerged as the primary hub for USD pairs. This structural divide created measurable—albeit minimal—basis spreads during periods of reduced market depth. Price discrepancies never exceeded $0.0164, showcasing efficient arbitrage mechanisms.

A persistent pattern emerged where USD pairs traded at slight premiums to USDT counterparts. Binance's XRPUSD averaged $0.00109 above its USDT pair, while Coinbase maintained a narrower $0.00079 gap. These micro-differentials highlight how exchange-specific liquidity dynamics can influence pricing even in highly efficient markets.

Ripple’s Bank Charter Faces Opposition from Major U.S. Banks

Ripple's ambitious plan to establish a federally licensed bank in the U.S. has encountered significant resistance from traditional financial institutions. The company's July 5th application to the Office of the Comptroller of the Currency seeks to create a national trust bank, potentially bridging crypto and traditional finance.

The Bank Policy Institute, representing 42 major banks including JPMorgan, Bank of America, and Morgan Stanley, has formally opposed the move. Their objections center around regulatory uncertainties in the crypto space, particularly regarding Ripple's proposed services like stablecoin issuance and digital asset custody.

This clash highlights the growing tension between innovative blockchain firms and established financial players. Ripple's potential access to Federal Reserve payment systems through a master account represents a strategic threat to traditional banking infrastructure.

SEC Battle Intensifies as XRP Adoption Surges Globally

The Ripple lawsuit faces renewed uncertainty as the SEC refuses to withdraw its appeal, despite Ripple stepping back from its own. U.S. District Judge Analisa Torres recently rejected a proposed settlement, prolonging a case that could redefine cryptocurrency regulation in the U.S. The SEC must update the appeals court by August 15, leaving the market in suspense over its next move.

Institutional confidence in XRP grows as its utility for global payments expands, driven by speed and cost efficiency. Meanwhile, Ripple's legal battle may catalyze clearer payroll regulations and enhance trust in cross-border crypto transactions.

Legal experts note no strict deadline compels SEC action, but the August 15 court report looms. Crypto commentator Vincent Van Code suggests the agency may respond before the deadline, though its strategy remains opaque.

XRP Price To Face Deeper Correction Ahead, Say Top Analysts

XRP is under significant selling pressure, having dropped below the critical $3 support level—a 6% decline from its recent peak of $3.63. Analysts warn the correction may deepen, citing technical indicators and weakening on-chain support.

Crypto analyst Ali Martinez highlights a sell signal from the TD Sequential indicator on XRP's 3-day chart, which historically precedes extended downturns. The token now faces thin support near $2.80, with stronger footing only emerging below $2.48—a level that could signal accelerated losses if breached.

XRP Price May Slide to $2.4: Analyst Cites Whale Selling, Bearish MVRV Cross

XRP faces mounting downward pressure as analysts predict a potential drop to the $2.40 support level. The correction follows a TD Sequential sell signal on the 3-day chart, identified by market watcher Ali Martinez. Whale activity and a bearish MVRV cross are exacerbating the sell-off.

Current metrics reveal a 4.1% daily decline, with losses stretching to 14.6% over two weeks. Despite the pullback, XRP maintains a 28.8% monthly gain—a testament to its earlier rally. Ripple's recent regulatory filings appear insufficient to counter the technical headwinds.

Martinez's chart analysis shows the Tom DeMark Sequential flashing warning signals at peak levels. The $2.40 support now serves as a critical litmus test for XRP's near-term trajectory. Market participants await either consolidation at this level or further downside continuation.

XRP Officially Goes Live on BDACS: Ripple Unlocks Explosive Institutional Growth in Korea

XRP has launched on BDACS, a regulated crypto custody platform in South Korea, marking a significant milestone for institutional adoption. The partnership enables compliant storage and usage of XRP across major Korean exchanges like Upbit, Coinone, and Korbit.

Ripple's strategic move follows its February deal with BDACS to enhance custody services. The Financial Services Commission's updated guidelines have paved the way for greater institutional involvement in digital assets, with XRP positioned as a key beneficiary.

XRP price remains stable near $2.93, with $2.96 acting as critical support. The asset's inclusion on BDACS underscores its dominance in Korea's crypto markets and Ripple's expanding Asian footprint.

XRP Faces Deeper Correction Risk Amid Bearish Signals and Whale Selloff

XRP is showing signs of weakening momentum after a sharp pullback from its recent peak, with technical indicators and large-scale sell-offs pointing to potential further downside. The cryptocurrency now trades at $2.94, down 3.7% over the past 24 hours and nearly 19% below its all-time high of $3.65 reached on July 18.

Analyst Ali Martinez highlighted a sell signal triggered by the Tom DeMark Sequential indicator on XRP’s 3-day chart, which preceded the current decline. Adding to the bearish pressure, whales have offloaded more than 720 million XRP in recent days. A 'death cross' in XRP’s MVRV ratio—a metric comparing market value to realized value—further underscores the risk, suggesting traders are sitting on diminished profits.

The key level to watch is $2.80; a breach could open the door for a drop toward $2.48. Despite the short-term headwinds, XRP remains up 29% over the past month, reflecting lingering bullish sentiment in the broader market.

Is XRP a good investment?

Sophia from BTCC presents a balanced view: 'XRP shows conflicting signals - technical indicators suggest caution while institutional adoption grows.' Key considerations:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 2.9962 USDT | Below 20MA (bearish) |

| Bollinger Bands | 2.7510-3.5838 | Testing lower range |

| MACD | 0.2137 | Bullish momentum building |

Sophia concludes: 'Risk-tolerant investors might accumulate at support levels ($2.75), but regulatory risks require careful position sizing.'

Medium-term hold with strict stop-loss below $2.75